|

|

import gradio as gr |

|

|

from rag import rbc_product |

|

|

from tool import rival_product |

|

|

from graphrag import marketingPlan |

|

|

from knowledge import graph |

|

|

from pii import derisk |

|

|

from classify import judge |

|

|

from entity import resolve |

|

|

|

|

|

|

|

|

head = """ |

|

|

<!-- Google tag (gtag.js) --> |

|

|

<script async src="https://www.googletagmanager.com/gtag/js?id=G-SRX9LDVBCW"></script> |

|

|

<script> |

|

|

window.dataLayer = window.dataLayer || []; |

|

|

function gtag(){dataLayer.push(arguments);} |

|

|

gtag('js', new Date()); |

|

|

|

|

|

gtag('config', 'G-SRX9LDVBCW'); |

|

|

</script> |

|

|

""" |

|

|

|

|

|

with gr.Blocks(head=head) as demo: |

|

|

with gr.Tab("Intro"): |

|

|

gr.Markdown(""" |

|

|

If you're experiencing declining market share, inefficiencies in your operations, here's how I can help: |

|

|

============== |

|

|

Marketing & Client Experience |

|

|

------------ |

|

|

- GraphRAG: Models customer-product relationship networks for next-best-action predictions |

|

|

- DSPy: Optimizes cross-sell/upsell prompt variations through A/B testing |

|

|

|

|

|

Risk & Audit |

|

|

------------ |

|

|

- GraphRAG: Maps transactional relationships into dynamic knowledge graphs to detect multi-layered fraud patterns |

|

|

- Tool Use: Integrates fraud detection APIs, anomaly scoring models, and regulatory compliance checkers |

|

|

- DSPy: Optimizes fraud explanation prompts for regulatory reporting |

|

|

- Explainable AI: Intuitive visualization to help stakeholder understand model risk and flaw |

|

|

|

|

|

Other Links: |

|

|

------------ |

|

|

- https://huggingface.co/spaces/kevinhug/clientX |

|

|

- https://kevinwkc.github.io/davinci/ |

|

|

""") |

|

|

|

|

|

with gr.Tab("RAG Recommender"): |

|

|

gr.Markdown(""" |

|

|

Objective: Dynamic RBC Product Recommender: Personalize Offers Using Customer Persona Insights |

|

|

================================================ |

|

|

- Retrieval: Public RBC Product Data |

|

|

- Recommend: RBC Product |

|

|

|

|

|

Potential Optimization |

|

|

------------ |

|

|

BM25 reranking using keyword |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Verbatim") |

|

|

out_product = gr.Textbox(label="Product") |

|

|

|

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

["Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low."] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend=gr.Button("Recommend") |

|

|

btn_recommend.click(fn=rbc_product, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Companies pour millions into product catalogs, marketing funnels, and user acquisition—yet many still face the same challenge: |

|

|

================== |

|

|

### 📉 Pain points: |

|

|

- High bounce rates and low conversion despite heavy traffic |

|

|

- Customers struggle to find relevant products on their own |

|

|

- One-size-fits-all promotions result in wasted ad spend and poor ROI |

|

|

|

|

|

### 🧩 The real question: |

|

|

What if your product catalog could *adapt itself* to each user in real time—just like your best salesperson would? |

|

|

|

|

|

### 🎯 The customer need: |

|

|

Businesses need a way to dynamically personalize product discovery, so every customer sees the most relevant items—without manually configuring hundreds of rules. |

|

|

|

|

|

## ✅ Enter: Product Recommender Systems |

|

|

|

|

|

By analyzing behavioral data, preferences, and historical purchases, a recommender engine surfaces what each user is most likely to want—boosting engagement and revenue. |

|

|

|

|

|

### 📌 Real-world use cases: |

|

|

- **Amazon** attributes up to 35% of its revenue to its recommender system, which tailors the home page, emails, and checkout cross-sells per user. |

|

|

- **Netflix** leverages personalized content recommendations to reduce churn and increase watch time—saving the company over $1B annually in retention value. |

|

|

- **Stitch Fix** uses machine learning-powered recommendations to curate clothing boxes tailored to individual style profiles—scaling personal styling. |

|

|

|

|

|

### 💡 Business benefits: |

|

|

- Higher conversion rates through relevant discovery |

|

|

- Increased average order value (AOV) via cross-sell and upsell |

|

|

- Improved retention and lower customer acquisition cost (CAC) |

|

|

|

|

|

If your product discovery experience isn’t working as hard as your marketing budget, it’s time to make your catalog intelligent—with recommendations that convert. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Tool Use Competitive Research"): |

|

|

gr.Markdown(""" |

|

|

Objective: Persona-Driven Financial Product Recommendations: Unlock Competitive Advantage & Feature Innovation |

|

|

================================================ |

|

|

- Retrieval: Public Product Data using Tavily Search |

|

|

- Recommend: Competition Product |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Verbatim") |

|

|

out_product = gr.Textbox(label="Product") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

["Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low."] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend=gr.Button("Recommend") |

|

|

btn_recommend.click(fn=rival_product, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Companies in competitive industries are constantly under pressure to innovate—but often face the same challenge: |

|

|

================== |

|

|

### 📉 Pain points: |

|

|

- Unable to identify gaps or opportunities in competitor products in real-time. |

|

|

- Lack of insight into customer feedback on competitor features. |

|

|

- Difficulty in predicting how new features will be received in the market. |

|

|

|

|

|

### 🧩 The real question: |

|

|

How can your product stay ahead of the competition without a clear understanding of what features your competitors are developing, and how they’re performing with customers? |

|

|

|

|

|

### 🎯 The customer need: |

|

|

What businesses really need is a data-driven approach to **competitor product research**, one that can identify trends, uncover feature gaps, and provide actionable insights to drive innovation in product development. |

|

|

|

|

|

## ✅ Solution: **Competitor Product Research for Feature Development** |

|

|

|

|

|

By leveraging AI, market intelligence, and competitive analysis tools, you can track competitor launches, analyze user sentiment, and evaluate feature performance across the board. This insight helps shape strategic product decisions—ensuring your team isn't building in the dark. |

|

|

|

|

|

### 📌 Real-world use cases: |

|

|

- **Spotify** tracks competitor music features, leveraging insights from users and music trends to introduce features like playlist sharing and collaborative playlists—leading to increased user engagement. |

|

|

- **Apple** regularly conducts competitor analysis to anticipate and outpace trends, such as implementing health tracking features before they became mainstream in wearables. |

|

|

- **Slack** uses competitor research to build features that cater to the evolving needs of remote teams, like advanced search functionality and integrations with other tools. |

|

|

|

|

|

### 💡 Business benefits: |

|

|

- **Informed product decisions**: Develop features that fill gaps and add value in ways competitors aren’t addressing. |

|

|

- **Faster time-to-market**: Avoid reinventing the wheel by learning from competitors’ successes and mistakes. |

|

|

- **Market positioning**: Stay one step ahead of competitors, ensuring your product remains the best solution for your target audience. |

|

|

|

|

|

With the right competitive research, you don’t just react to the market—you anticipate it. |

|

|

""") |

|

|

with gr.Tab("Graphrag Marketing Plan"): |

|

|

gr.Markdown(""" |

|

|

Objective: Develop a Targeted Marketing Plan Aligned with Customer Personas |

|

|

======================= |

|

|

- Reasoning from context, answering the question |

|

|

""") |

|

|

|

|

|

marketing = """ |

|

|

A business model is not merely a static description but a dynamic ecosystem defined by five interdependent pillars: |

|

|

|

|

|

Value Creation (What you sell): The core offering must solve a critical pain point or unlock untapped demand. This is the foundation of your value proposition—quantifiable (e.g., cost efficiency) or qualitative (e.g., exceptional user experience)—that differentiates you in the market. |

|

|

|

|

|

Delivery Infrastructure (How you deliver): Channels and partnerships must align to ensure seamless access to your offering. For instance, a SaaS company might leverage cloud platforms for instant scalability, while a luxury brand prioritizes exclusive retail partnerships. |

|

|

|

|

|

Customer Lifecycle Dynamics: |

|

|

|

|

|

Acquisition: How do users discover you? Channels like organic search (SEO), targeted ads, or influencer partnerships must map to your customer segments’ behaviors. |

|

|

|

|

|

Activation: Do first-time users experience immediate value? A fitness app, for example, might use onboarding tutorials to convert sign-ups into active users. |

|

|

|

|

|

Retention: Is engagement sustained? Metrics like churn rate and CLV reveal whether your model fosters loyalty through features like personalized content or subscription perks. |

|

|

|

|

|

Referral: Do users become advocates? Incentivize sharing through referral programs or viral loops (e.g., Dropbox’s storage rewards). |

|

|

|

|

|

Revenue Architecture (How you monetize): Align pricing models (subscriptions, freemium tiers) with customer willingness-to-pay. For instance, a niche market might sustain premium pricing, while a mass-market product prioritizes volume. |

|

|

|

|

|

Cost Symmetry: Every activity—from R&D to customer support—must balance against revenue streams. A low-cost airline, for example, optimizes for operational efficiency to maintain profitability. |

|

|

|

|

|

Strategic Imperatives for Modern Business Models |

|

|

|

|

|

Systemic Integration: Ohmae’s “3C’s” (Customer, Competitor, Company) remind us that acquisition channels and value propositions must adapt to shifting market realities. For instance, a retailer might pivot from brick-and-mortar to hybrid models post-pandemic. |

|

|

|

|

|

Data-Driven Iteration: Use AARRR metrics to identify leaks in the funnel. If activation rates lag, refine onboarding; if referrals stagnate, enhance shareability. |

|

|

|

|

|

Scalability through Partnerships: Key partners (e.g., tech vendors, logistics providers) can reduce overhead while expanding reach—critical for transitioning from niche to mass markets. |

|

|

|

|

|

By framing each component as a strategic variable rather than a fixed element, businesses can continuously adapt to disruptions—a necessity in Ohmae’s vision of fluid, customer-first strategy. |

|

|

""" |

|

|

in_verbatim = gr.Textbox(label="Context", value=marketing, visible=False) |

|

|

in_question = gr.Textbox(label="Persona") |

|

|

out_product = gr.Textbox(label="Plan") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

Low APR and great customer service. I would highly recommend if you’re looking for a great credit card company and looking to rebuild your credit. I have had my credit limit increased annually and the annual fee is very low. |

|

|

"""] |

|

|

], |

|

|

[in_question] |

|

|

) |

|

|

btn_recommend = gr.Button("Reasoning") |

|

|

btn_recommend.click(fn=marketingPlan, inputs=[in_verbatim, in_question], outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

Benefits of a Marketing Campaign Generator |

|

|

=============== |

|

|

- Accelerated Campaign Launches |

|

|

Quickly generates tailored campaigns, reducing go-to-market time from weeks to hours. |

|

|

|

|

|

- Improved Targeting & Personalization |

|

|

Uses customer data and behavior to craft messages that resonate with specific segments. |

|

|

""") |

|

|

|

|

|

with gr.Tab("Personalized Knowledge Graph"): |

|

|

gr.Markdown(""" |

|

|

Objective: Transform Personal Pain Points into Actionable Insights with a Dynamic Knowledge Graph Framework |

|

|

===================================== |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Question") |

|

|

out_product = gr.JSON(label="Knowledge Graph") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

Representative: "Thank you for calling Goldman Sachs Credit Card Services. My name is Sarah. May I have your full name and the last 4 digits of your card number for verification?" |

|

|

|

|

|

Customer: "This is Michael Chen, card ending 5402." |

|

|

|

|

|

Representative: "Thank you, Mr. Chen. I show you have an Apple Card account opened in 2023. How can I assist you today?" (Reference: Search Result Apple Card context) |

|

|

|

|

|

Customer: "I'm disputing a $329 charge from TechElectronics from March 15th. I never received the item." |

|

|

|

|

|

Representative: "I understand your concern. Let me initiate a dispute investigation. Per our process (Search Result BBB complaint handling): |

|

|

|

|

|

We'll apply a temporary credit within 24 hours |

|

|

|

|

|

Our team will contact the merchant |

|

|

|

|

|

You'll receive email updates at [email protected] |

|

|

|

|

|

Final resolution within 60 days |

|

|

|

|

|

Would you like me to proceed?" |

|

|

|

|

|

Customer: "Yes, but what if they fight it?" |

|

|

|

|

|

Representative: "If the merchant disputes your claim, we'll: |

|

|

|

|

|

Review all evidence using our 3-phase verification system (Search Result multi-stage investigation) |

|

|

|

|

|

Consider your purchase protection benefits |

|

|

|

|

|

Escalate to senior specialists if needed |

|

|

|

|

|

For security, never share your CVV (339) or full card number with callers. Always call back using the number on your physical card (Search Result scam warning)." |

|

|

|

|

|

Customer: "Can I make a partial payment on my balance while this is pending?" |

|

|

|

|

|

Representative: "Absolutely. We offer: |

|

|

"minimum_payment": "$35 due April 25", |

|

|

"hardship_program": "0% APR for 6 months", |

|

|

"custom_plan": "Split $600 balance over 3 months" |

|

|

Would you like to enroll in any of these?" |

|

|

|

|

|

Customer: "The 3-month plan, please." |

|

|

|

|

|

Representative: "Confirmed. Your next payment of $200 will process May 1st. A confirmation email with dispute case #GS-2025-0422-8830 is being sent now. Is there anything else?" |

|

|

|

|

|

Customer: "No, thank you." |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Graph It!") |

|

|

btn_clear = gr.ClearButton(components=[out_product]) |

|

|

btn_recommend.click(fn=graph, inputs=[in_verbatim, out_product], outputs=out_product) |

|

|

|

|

|

|

|

|

gr.Markdown(""" |

|

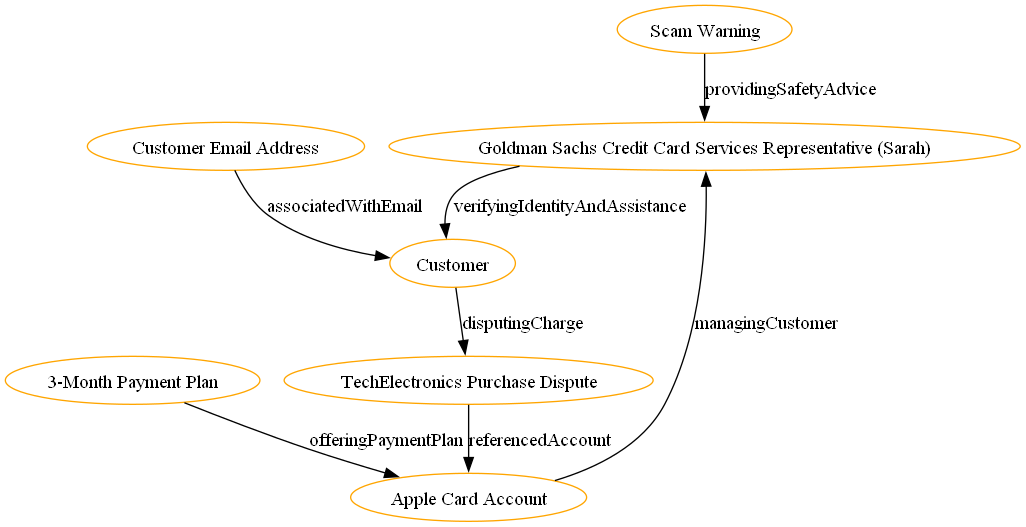

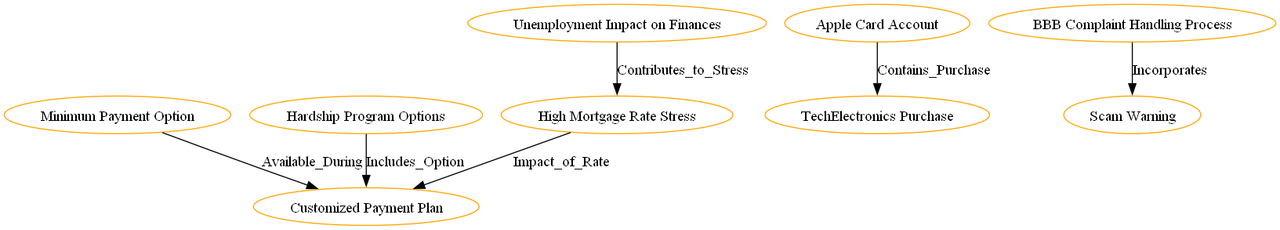

|

Example of Customer Profile in Graph |

|

|

================= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#### Customer Needs and Pain Points |

|

|

https://i.postimg.cc/D03Sstqd/knowledge-graph1.png |

|

|

#### Accumulated Interaction for the same Customer Needs and Pain Points |

|

|

https://i.postimg.cc/9ffZQ5pD/knowledge-graph2.png |

|

|

|

|

|

Benefits of a Knowledge Graph |

|

|

============ |

|

|

- Smarter Data Relationships |

|

|

Connects siloed data across domains to create a holistic, contextual view. |

|

|

|

|

|

- Improved Search & Discovery |

|

|

Enables semantic search—understanding meaning, not just keywords. |

|

|

|

|

|

- Enhanced Decision-Making |

|

|

Surfaces hidden patterns and relationships for better analytics and insights. |

|

|

|

|

|

- Data Reusability |

|

|

Once created, knowledge graphs can be repurposed across multiple use cases (e.g., search, recommendation, fraud detection). |

|

|

""") |

|

|

|

|

|

with gr.Tab("PII Audit"): |

|

|

gr.Markdown(""" |

|

|

Objective: Automated PII Data Removal: Proactive Compliance & Risk Mitigation |

|

|

================================================ |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Peronal Info") |

|

|

out_product = gr.Textbox(label="PII") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

He Hua (Hua Hua) Director |

|

|

[email protected] |

|

|

+86-28-83505513 |

|

|

|

|

|

Alternative Address Format: |

|

|

Xiongmao Ave West Section, Jinniu District (listed in some records as 610016 postcode) |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Mask PII") |

|

|

btn_recommend.click(fn=derisk, inputs=in_verbatim, outputs=out_product) |

|

|

gr.Markdown(""" |

|

|

Benefits of Entity Removal |

|

|

================== |

|

|

- Data Privacy & Compliance |

|

|

Ensures sensitive information (names, emails, phone numbers, etc.) is anonymized to comply with GDPR, HIPAA, or other regulations. |

|

|

|

|

|

- Improved Data Quality |

|

|

Removes noise (e.g., irrelevant names or addresses) to make datasets cleaner and more usable for modeling or analysis. |

|

|

|

|

|

- Enhanced Focus for NLP Models |

|

|

Allows downstream tasks (like sentiment analysis or topic modeling) to focus on content rather than personal identifiers. |

|

|

""") |

|

|

|

|

|

|

|

|

with gr.Tab("Classify & Guardrail"): |

|

|

gr.Markdown(""" |

|

|

Objective: Streamline Customer Insights: Auto-Classify Feedback for Product Optimization |

|

|

================================================ |

|

|

- multi class classification, could have multiple label for 1 feedback |

|

|

- fix classification in this use case: online banking, card, auto finance, mortgage, insurance |

|

|

- LLM Judge to evaluate relevancy |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Customer Feedback separate by ;") |

|

|

out_product = gr.Textbox(label="Classification & Evaluation") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[ |

|

|

""" |

|

|

"The online portal makes managing my mortgage payments so convenient."; |

|

|

"RBC offer great mortgage for my home with competitive rate thank you"; |

|

|

"Low interest rate compared to other cards I’ve used. Highly recommend for responsible spenders."; |

|

|

"The mobile check deposit feature saves me so much time. Banking made easy!"; |

|

|

"Affordable premiums with great coverage. Switched from my old provider and saved!" |

|

|

""" |

|

|

] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend = gr.Button("Classify & Evaluation") |

|

|

btn_recommend.click(fn=judge, inputs=in_verbatim, outputs=out_product) |

|

|

gr.Markdown(""" |

|

|

Benefits of Multi Class Classification |

|

|

================== |

|

|

- Precision Decision-Making |

|

|

Automates complex categorization tasks (e.g., loan risk tiers, transaction types) with >90% accuracy, reducing human bias. |

|

|

|

|

|

- Operational Efficiency |

|

|

Processes 10,000+ transactions/cases per minute vs. hours manually (e.g., JP Morgan’s COiN platform reduced 360k loan doc hours to seconds). |

|

|

|

|

|

- Risk Mitigation |

|

|

Proactively flags 5+ fraud types (identity theft, money laundering) with 40% fewer false positives than rule-based systems. |

|

|

|

|

|

- Regulatory Compliance |

|

|

Auto-classifies documents for FINRA/SEC audits (e.g., Morgan Stanley uses NLP to categorize 3M+ annual communications into 50+ compliance buckets). |

|

|

""") |

|

|

|

|

|

with gr.Tab("Resolution for Call Center"): |

|

|

gr.Markdown(""" |

|

|

Objective: Proactive Entity Mapping: Clarifying Critical Elements in Complex Call Analysis for Strategic Insight |

|

|

================================================ |

|

|

""") |

|

|

in_verbatim = gr.Textbox(label="Content") |

|

|

out_product = gr.Textbox(label="Entity Resolution") |

|

|

|

|

|

gr.Examples( |

|

|

[ |

|

|

[""" |

|

|

Representative: "Thank you for calling Goldman Sachs Credit Card Services. My name is Sarah. May I have your full name and the last 4 digits of your card number for verification?" |

|

|

|

|

|

Customer: "This is Michael Chen, card ending 5402." |

|

|

|

|

|

Representative: "Thank you, Mr. Chen. I show you have an Apple Card account opened in 2023. How can I assist you today?" (Reference: Search Result Apple Card context) |

|

|

|

|

|

Customer: "I'm disputing a $329 charge from TechElectronics from March 15th. I never received the item." |

|

|

|

|

|

Representative: "I understand your concern. Let me initiate a dispute investigation. Per our process (Search Result BBB complaint handling): |

|

|

|

|

|

We'll apply a temporary credit within 24 hours |

|

|

|

|

|

Our team will contact the merchant |

|

|

|

|

|

You'll receive email updates at [email protected] |

|

|

|

|

|

Final resolution within 60 days |

|

|

|

|

|

Would you like me to proceed?" |

|

|

|

|

|

Customer: "Yes, but what if they fight it?" |

|

|

|

|

|

Representative: "If the merchant disputes your claim, we'll: |

|

|

|

|

|

Review all evidence using our 3-phase verification system (Search Result multi-stage investigation) |

|

|

|

|

|

Consider your purchase protection benefits |

|

|

|

|

|

Escalate to senior specialists if needed |

|

|

|

|

|

For security, never share your CVV (339) or full card number with callers. Always call back using the number on your physical card (Search Result scam warning)." |

|

|

|

|

|

Customer: "Can I make a partial payment on my balance while this is pending?" |

|

|

|

|

|

Representative: "Absolutely. We offer: |

|

|

"minimum_payment": "$35 due April 25", |

|

|

"hardship_program": "0% APR for 6 months", |

|

|

"custom_plan": "Split $600 balance over 3 months" |

|

|

Would you like to enroll in any of these?" |

|

|

|

|

|

Customer: "The 3-month plan, please." |

|

|

|

|

|

Representative: "Confirmed. Your next payment of $200 will process May 1st. A confirmation email with dispute case #GS-2025-0422-8830 is being sent now. Is there anything else?" |

|

|

|

|

|

Customer: "No, thank you." |

|

|

"""] |

|

|

], |

|

|

[in_verbatim] |

|

|

) |

|

|

btn_recommend=gr.Button("Resolve") |

|

|

btn_recommend.click(fn=resolve, inputs=in_verbatim, outputs=out_product) |

|

|

|

|

|

gr.Markdown(""" |

|

|

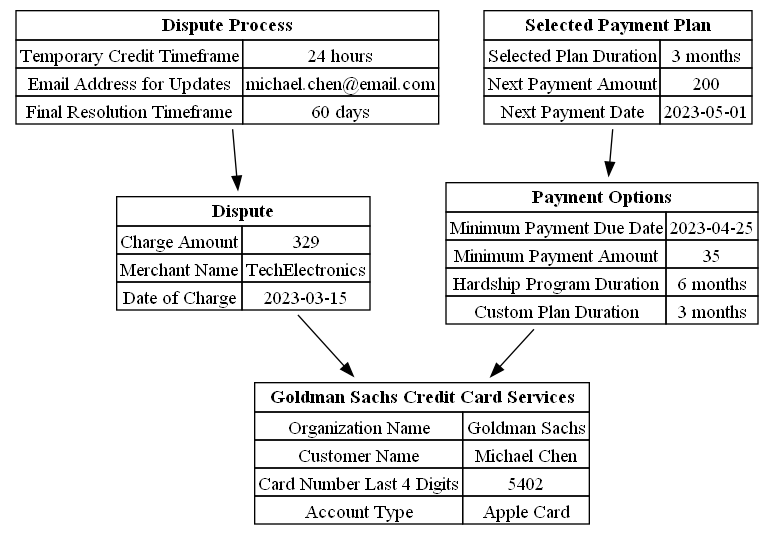

Example of Call Resolution |

|

|

=============== |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#### Resolution for Clear Picture about Customer Issue |

|

|

https://i.postimg.cc/J4qsDYtZ/entity.png |

|

|

|

|

|

Companies like RBC, Comcast, or BMO often face a recurring challenge: long, complex customer service calls filled with vague product references, overlapping account details, and unstructured issue descriptions. This makes it difficult for support teams and analytics engines to extract clear insights or resolve recurring pain points across accounts and products. |

|

|

|

|

|

How can teams automatically stitch together fragmented mentions of the same customer, product, or issue—across call transcripts, CRM records, and support tickets—to form a unified view of the actual problem? |

|

|

|

|

|

That's where Entity Resolution comes in. By linking related entities hidden across data silos and messy text (like "my internet box" = "ARRIS TG1682G" or "John Smith, J. Smith, and [email protected]"), teams gain a clearer, contextual understanding of customer frustration in real-time. |

|

|

|

|

|

For example, Comcast reduced repeat service calls by 17% after deploying entity resolution models on long call transcripts—turning messy feedback into actionable product insights and faster resolutions. |

|

|

|

|

|

The result? Less agent time lost, higher customer satisfaction, and data pipelines that actually speak human. |

|

|

""") |

|

|

demo.launch(allowed_paths=["."]) |